Net to gross hourly pay calculator

How Your Tennessee Paycheck Works While your employer typically covers 50 of your FICA taxes this is not the case if you are a self-employed worker or an independent contractor. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross.

Calculating Income Hourly Wage Youtube

To use the net to gross calculator you will be required to provide the following information.

. Acest calculator poate fi folosit pentru o estimare cu privire la taxele salariale pentru cazurile generale și nu poate înlocui specialistul în. Student loan plan if relevant. This calculator is for you.

A pay period can be weekly fortnightly or monthly. To calculate your annual salary take your hourly wage and multiply it by the number of paid hours you work per week and then by the number of paid weeks you work per year. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month.

Tool Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Calcul salariu de la 3200 brut la net. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year.

65000 - Taxes - Surtax - Health Premium -. The average monthly net salary in the. This places Ireland on the 8th place in the International.

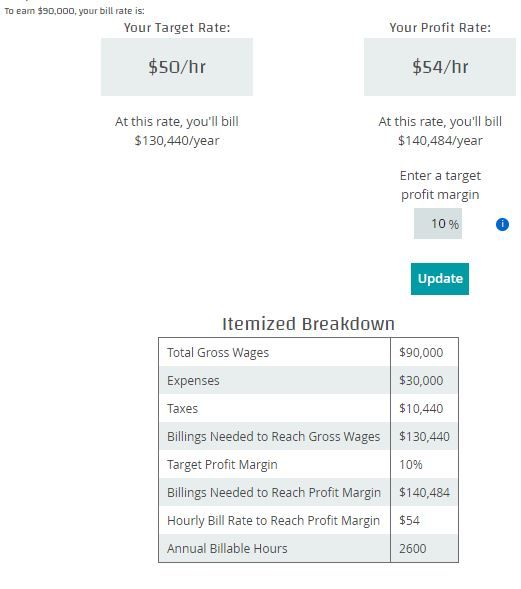

Gross pay is the amount of pay an employee earns before any taxes and deductions are taken out while net pay is the amount an employee. Use this federal gross pay calculator to gross up wages based on net pay. Enter Your Salary and the.

The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Pay calculator Use this calculator to quickly estimate how much tax you will need to pay on your income. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be.

The total tax you. 000 Year Month Biweek. Your taxcode if you know it.

YEAR Net Salary Per Province Gross Salary is. For example if an employee earns 1500 per week the individuals annual. Next select the Filing Status drop down menu and choose which option applies.

First enter your Gross Salary amount where shown. Difference between gross pay and net pay. Required net monthly pay.

It can be used for the. Net To Gross Paycheck Calculator This calculator helps you determine the gross paycheck needed to provide a required net amount. The Hourly Wage Calculator Dont know what your salary is just the hourly rate.

Youll then get a breakdown of your total tax liability and take-home pay. Follow these simple steps to calculate your salary after tax in Austria using the Austria Salary Calculator 2022 which is updated with the 202223 tax tables. Kenya Net Pay Calculator with Income Tax Rates Of January 2021 Calculate Gross Salary before PAYE Net Pay NHIF NSSF Deductions.

Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week and has worked 52 weeks during the year. The net-pay calculator uses the latests PAYE NHIF NSSF values to calculate the net-pay and present it in a simple payslip as it could look in in a typical. Guide to getting paid Our salary calculator indicates that on a 2149 salary gross income of 2149 per year you receive take home pay of 2149 a net wage of 2149.

45 000 - Taxes - Surtax - CPP - EI 35. First enter the net paycheck you require. This calculator is always up to date and conforms to official Australian Tax Office.

Using the United States Tax Calculator is fairly simple. You can change the calculation by saving a new Main income. To stop the auto-calculation you will need to delete.

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Need to start with an employees net after-tax pay and work your way back to gross pay. Let The Hourly Wage Calculator do all the sums for you - after the tax calculations see the annual pay and the.

The PAYE Calculator will auto calculate your saved Main gross salary. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Pay And Net Pay What S The Difference Paycheckcity

Salary Formula Calculate Salary Calculator Excel Template

3 Ways To Calculate Your Hourly Rate Wikihow

Net Pay Calculator Clearance 59 Off Ilikepinga Com

Hourly To Salary What Is My Annual Income

Net To Gross Calculator

How To Calculate Gross Pay Youtube

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

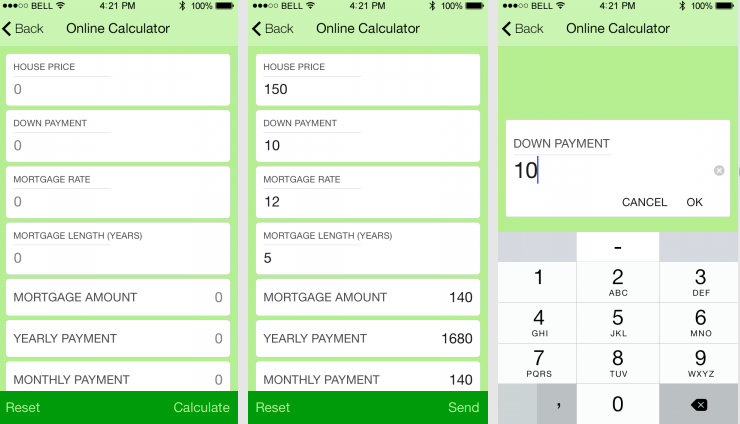

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Apo Bookkeeping

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math